US Added Fewer Jobs Than Expected in January, Boosting Case for Stimulus

The report will likely influence negotiations over U.S. President Biden’s $1.9 trillion stimulus package over the coming weeks.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/QOBM2EV775CJVA6TAIKVJSQHQM.jpg)

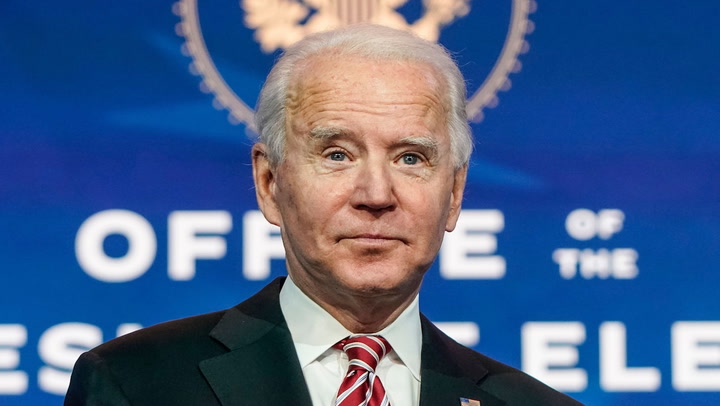

U.S. President Joe Biden

The U.S. added 49,000 jobs in January, fewer than the 105,000 expected, causing unemployment to fall from 6.7% to 6.3%.

The number of jobs added was a rebound from December's job loss of 277,000.

“In January, notable job gains in professional and business services and in both public and private education were offset by losses in leisure and hospitality, in retail trade, in health care, and in transportation and warehousing,” the U.S. Bureau of Labor Statistics report said. There are still 10.1 million unemployed, the BLS added.

The labor force participation rate – the percentage of the American population that is either working or actively looking for work – ticked down slightly to 61.4% from 61.5% in the previous month's report.

The report will likely affect negotiations over U.S. President Joe Biden’s $1.9 trillion stimulus package in the coming months, said former Federal Reserve macroeconomist Claudia Sahm. The stimulus bill and future stimulus in the U.S. could have an upward effect on asset prices and may produce higher inflation in the world’s leading economy, giving bitcoin (BTC) a test as an inflation-hedge asset.

“The political spin on the employment report tomorrow will be intense,” Sahm said in an email on Thursday. “I do not expect the numbers to materially affect the relief negotiations. The debate is about whether $1.9 trillion is too big or not. One month of data from the Bureau of Labor Statistics will not be decisive. But you will hear politicians pull numbers that suit their cause.”

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

:format(jpg)/downloads.coindesk.com/arc/failsafe/user/1x1.png)