Fairfax County, Virginia, Pension Funds Exposed to Genesis Bankruptcy

Two pension funds from the county invested $35 million in a VanEck fund listed as a Genesis creditor.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FCJNATWY6ZEZHCNETIRQR2PVAY.jpg)

Two pension funds from Virginia's Fairfax County have ties to bankrupt crypto lender Genesis Capital. (Gerville/iStockphoto/Getty Images)

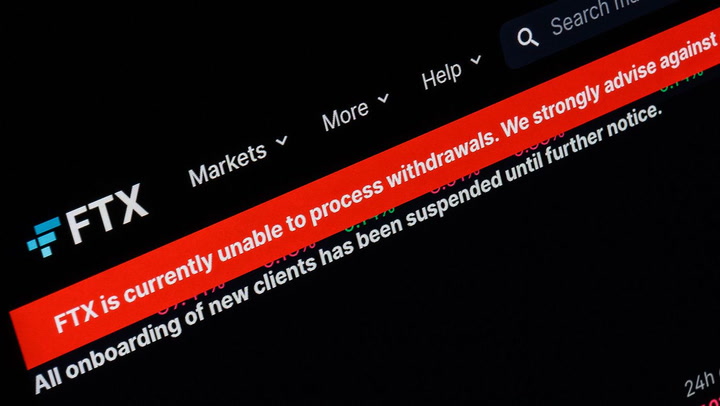

Genesis Global Holdco, the parent company of cryptocurrency lender Genesis Global Capital and a sister company of CoinDesk, filed for Chapter 11 bankruptcy protection late Thursday because of its exposure to collapsed hedge fund Three Arrows Capital and fallen crypto exchange FTX.

Genesis owes over $3.5 billion to its top 50 creditors – and one of the creditors has ties to a $6.8 billion pension fund system in Fairfax County, Virginia.

The list of creditors in the bankruptcy filing included the New Finance Income Fund from global asset manager VanEck with a $53 million claim against Genesis. The fund launched in December 2021 with a strategy of forming short-term lending arrangements with digital-asset entities to achieve high yields, according to VanEck’s website.

Last July, VanEck made headlines when two of the funds in the $6.8 billion Fairfax pension system – the Fairfax County Employees’ Retirement System and the Fairfax County Police Officers Retirement System – invested a combined $35 million in the VanEck fund as part of a then-new yield strategy, which also included an investment in Parataxis Capital.

The Fairfax County Police Officers Retirement System, which is led by Chief Investment Officer Katherine Molnar and which was managing about $1.8 billion as of last summer, has invested in the crypto industry since 2019 – a notable and extremely rare step for pension funds. Prior investments have included a $50 million commitment in Morgan Creek Capital’s blockchain fund.

Molnar didn't immediately respond to a request for comment.

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6205601f-70f8-400c-8219-e81039da93cc.png)