FTX Bankruptcy Estate Consolidates Arbitrum Airdrop Tokens Into Single Wallet

The estate now holds 33,125 ARB tokens worth around $42,000.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/XCP4F42MENAKFOFSN76KH5B2RU.jpg)

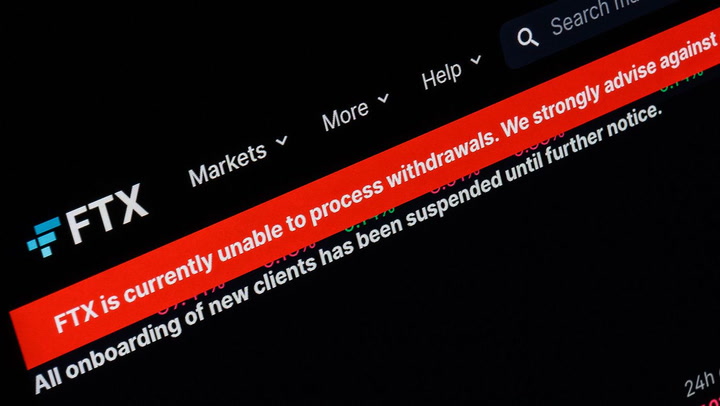

A digital wallet controlled by the FTX bankruptcy estate has received several tranches of the Arbitrum (ARB) airdrop from wallets linked to Alameda Research, on-chain data shows.

According to Arbiscan, a block explorer for layer 2 blockchain Arbitrum, the wallet now holds 33,125 ARB tokens worth around $42,000 at press time.

The wallet also holds $10 million worth of USD coin (USDC), almost $3 million of wrapped BTC (WBTC) and $4 million of ether (ETH), all of which have been consolidated from the same Alameda-linked wallets since Nov. 13, two days after FTX filed for bankruptcy. Alameda is a trading firm that was affiliated with FTX and that also filed for bankruptcy.

All held tokens are on the Arbitrum blockchain, a network Alameda has been active on since 2021 by providing liquidity to protocols like Sushi and Stargate Finance.

After airdropping its early users with 1.275 billion tokens, Arbitrum has a market capitalization of $1.6 billion as the token trades at $1.27, according to CoinMarketCap.

The FTX bankruptcy estate has been attempting to consolidate various tokens and investments in the past few weeks. It filed a motion on Wednesday that will see it recover $460 million, including $404 million in cash, from little-known Bahamian hedge fund Modulo Capital.

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

:format(jpg)/www.coindesk.com/resizer/fczAGHsWLFXiMV23oZZmkW19Ots=/arc-photo-coindesk/arc2-prod/public/D4HEG34XFVFVJHPXEEJAEFZ3SI.jpg)